The Buzz on Paul Burrowes - Realtor David Lyng Real Estate

Table of ContentsSome Ideas on Paul Burrowes - Realtor David Lyng Real Estate You Need To KnowThe Greatest Guide To Paul Burrowes - Realtor David Lyng Real EstateThe Buzz on Paul Burrowes - Realtor David Lyng Real EstateFacts About Paul Burrowes - Realtor David Lyng Real Estate RevealedThe Paul Burrowes - Realtor David Lyng Real Estate PDFs

Seasoned financiers may try to time the marketplace and sell later on to increase their total assets. The buy-and-hold method might additionally be used with business actual estate. Rather than leasing the building to residential tenants, the building is rented to long-term commercial local business owner. https://www.mixcloud.com/paulbrealtor/. are comparable to buy-and-hold because financiers purchase the asset to hold on to it for the long term.Trip leasings can supply considerable gains via greater rental prices however may need extra in upkeep and maintenance costs. A fix-and-flip investment strategy entails acquiring a home to make repair services and offer. Known as residence flipping, capitalists prepare to hold on to a fix-and-flip home for a much shorter duration of time.

Many investors count on financing to start spending, whether you pick a residential or industrial service. You have a few terrific funding alternatives readily available when it comes to investing in genuine estate.

The benefits of purchasing property are many. With well-chosen assets, capitalists can enjoy foreseeable capital, superb returns, tax obligation advantages, and diversificationand it's feasible to utilize real estate to develop wide range. Thinking regarding spending in actual estate? Here's what you need to learn about realty benefits and why realty is taken into consideration an excellent investment.

The 6-Second Trick For Paul Burrowes - Realtor David Lyng Real Estate

The advantages of buying realty include passive income, stable capital, tax advantages, diversification, and leverage. Property investment trusts (REITs) offer a means to purchase realty without needing to have, operate, or money properties. Capital is the internet earnings from a realty financial investment after home loan payments and operating budget have actually been made.

Real estate values tend to boost over time, and with an excellent investment, you can turn an earnings when it's time to market. As you pay down a residential property home loan, you build equityan asset that's part of your net worth. And as you build equity, you have the take advantage of to get more homes and increase money flow and wealth also extra.

Property has a lowand in some cases negativecorrelation with other significant possession classes. This means the enhancement of genuine estate to a profile of diversified possessions can decrease portfolio volatility and provide a greater return per device of threat. Take advantage of is the use of various financial instruments or obtained capital (e.g., debt) to enhance an investment's potential return.

Because realty is a substantial possession and one that can serve as collateral, funding is easily available. Real estate returns differ, relying on elements such as location, property class, and monitoring. Still, a number that lots of financiers aim for is to defeat the typical returns of the S&P 500what many individuals describe when they state, "the market." The rising cost of living hedging ability of real estate originates from the favorable relationship in between GDP - https://penzu.com/p/03f4346b7ca02e2b growth and the demand for genuine estate.

How Paul Burrowes - Realtor David Lyng Real Estate can Save You Time, Stress, and Money.

This, in turn, converts right into greater capital worths. Real estate often tends to maintain the purchasing power of resources by passing some of the inflationary pressure on to occupants and by incorporating some of the inflationary pressure in the kind of capital recognition.

Lastly, residential or commercial properties funded with a fixed-rate finance will certainly see the relative quantity of the monthly home mortgage payments fall over time-- as an example $1,000 a month as a fixed settlement will come to be less troublesome as rising cost of living erodes the acquiring power of that $1,000. Often, a main house is not considered to be a realty investment given that it is used as one's home.

Little Known Facts About Paul Burrowes - Realtor David Lyng Real Estate.

And, if this does happen, you might be accountable to pay taxes on those gains. In spite of all the benefits of buying realty, there are disadvantages. One of the primary ones is the lack of liquidity (or the relative trouble in transforming a property right into cash and cash money into an asset).

Also with the aid of a broker, it can take a few weeks of work simply to discover the ideal counterparty. Still, real estate is a distinct property course that's easy to understand and can boost the risk-and-return profile of a capitalist's portfolio. Scotts Valley, California, homes for sale. By itself, realty uses cash money flow, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge versus inflation

You need to read the syllabus very carefully for a description of the dangers related to an investment in JLL Earnings Residential Property Count On. Several of these dangers consist of however are not restricted to the following: Because there is no public trading market for shares of our typical supply, repurchases of shares by us after an one-year minimum holding period will likely be the only way to get rid check it out of your shares.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Lark Voorhies Then & Now!

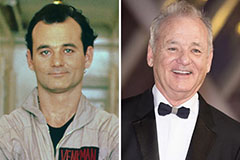

Lark Voorhies Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!